Introducing FlexProtect™ Connected Car!

Vehicle Finance

The FlexProtect solution for Vehicle Finance helps multiple members of the Pre-owned Vehicle Supply Chain reduce risk, drive new revenue streams and operate more efficiently.

With hundreds of dealers across the US relying on our Platform Services every day to support over a Quarter Million telematics devices, FlexProtect’s advanced technology is redefining the game for Vehicle Finance Solution Providers.

THE VEHICLE FINANCE ECOSYSTEM

PAYMENT ASSURANCE

The FlexProtect Payment Assurance Service takes loan management and risk reduction to new levels of performance. From high impact analytics, and flexible reports to lightning fast location updates, loan tracking and easy recovery order management, FlexProtect breaks the mold of legacy GPS offerings to deliver data-driven insights, better collections and less risk.

-

Dashboard Analytics

-

Unlimited Geofences

-

Scheduled Geofences

-

Visual Loan Manager

-

Enhanced Compliance

-

Role Based Security

-

Mobile Install App

-

Impound Notification

-

No Device Lock-in

ADVANCED ANALYTICS

-

Powerful Dashboards

-

Role-Based Dashboards

-

Insightful Graphics

-

Click-thru to live details

-

Custom Analytics

-

Device Performance

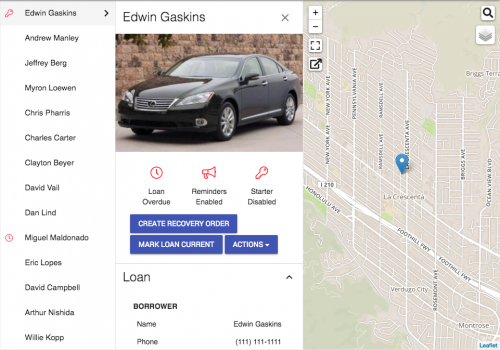

LOAN MANAGEMENT

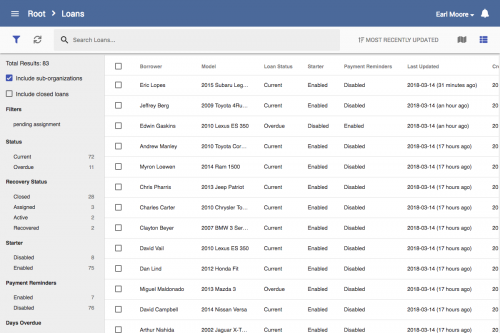

For maximum return on their portfolios, Automotive Lenders need new tools to better manage their loans. The FlexPRotect Loan Management application provides a simple interface to help manage a complex process and lets Loan Managers focus on their highest risk loans.

-

Automated Risk Assessment

-

Sort Loans by Risk Level

-

Enforce Collection Metrics

-

Payment Reminders

-

Starter Disable

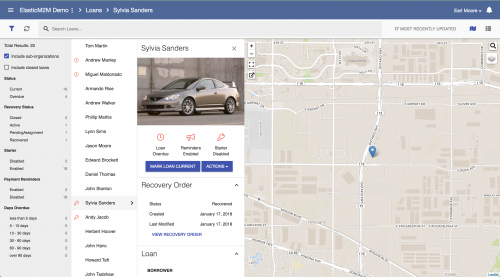

RECOVERY MANAGEMENT

When collection efforts are exhausted and collateral recovery is required, lenders can rely on the FlexProtect Recovery Management Application. With simple recovery order creation and assignment and secure system access for repo agents, vehicles can be returned faster and with less risk.

-

Easy Recovery Order Creation

-

Repo Agent Mobile App

-

Marketplace for Repo Bids

-

Token-based Repo Security

-

Impound Notification

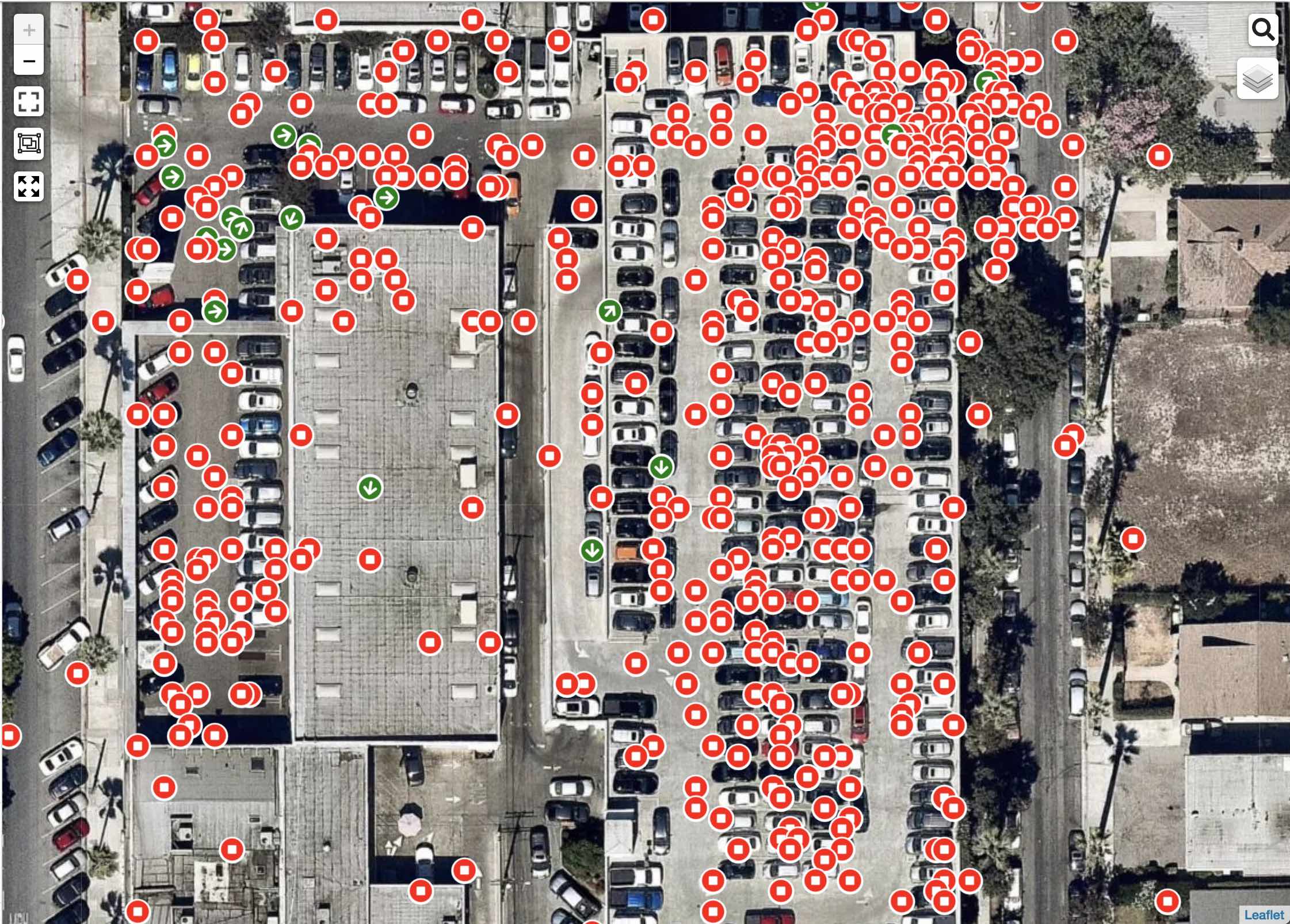

INVENTORY MANAGEMENT

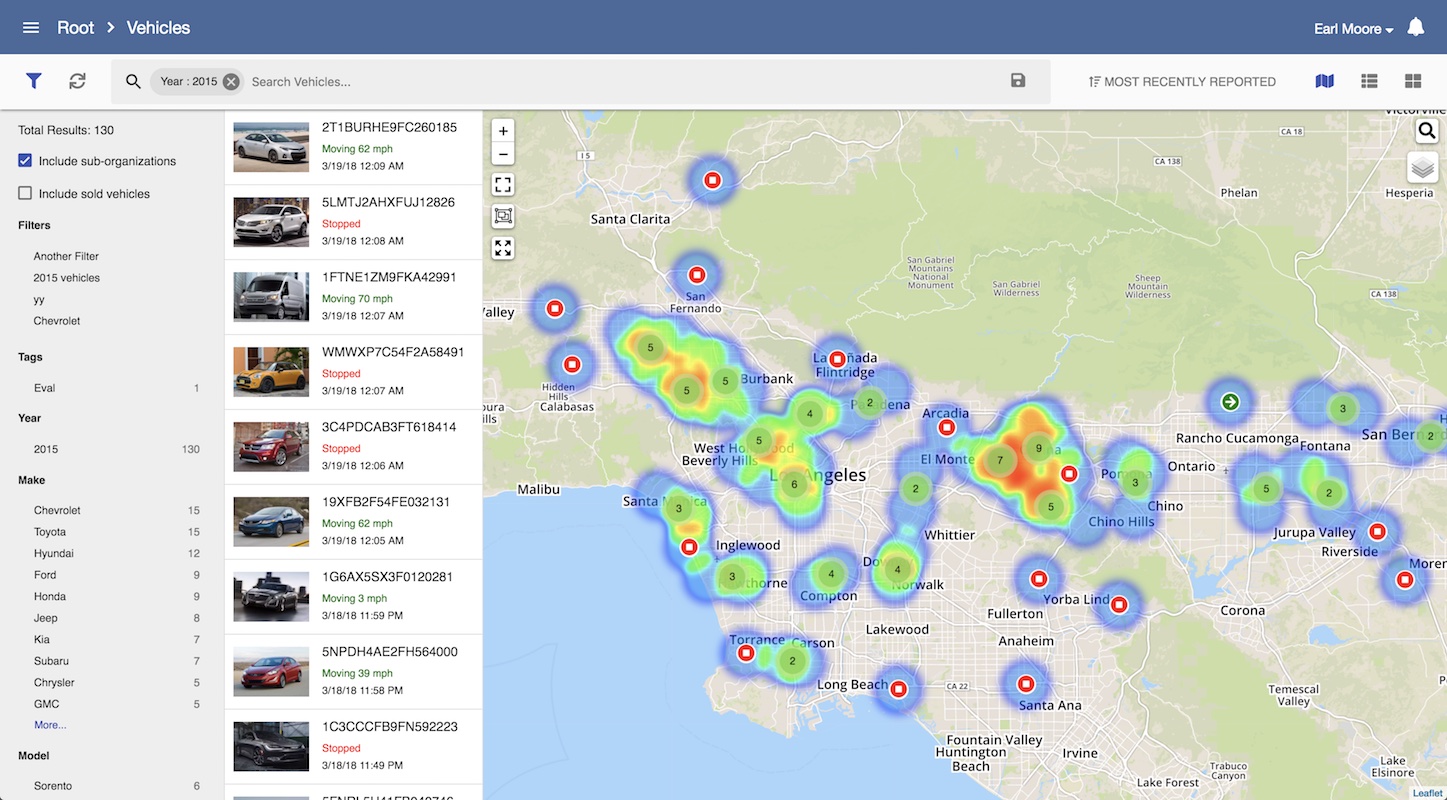

With simple to set up geofences and advanced search features, dealers will never lose track of a vehicle again. Easily schedule alerts for unauthorized vehicle movement, monitor battery status and generate powerful reports that can make floor plan audits a breeze.

-

Geofence Alerts

-

Low Battery Alerts

-

Advanced Search

-

Theft Prevention

-

Floor Plan Audits

ADVANCED THEFT PROTECTION

The FlexProtect Vehicle Finance Solution includes national GPS coverage on Tier-One data providers, to ensure rapid recovery of any vehicles reported stolen. Our Platform also supports telematics devices that can provide starter disable features as well as protective services like Silent Alarm for vehicle break-ins.

-

Simple SVR Reporting

-

Recovery Token for Law Enforcement

-

Vehicle Found Alert

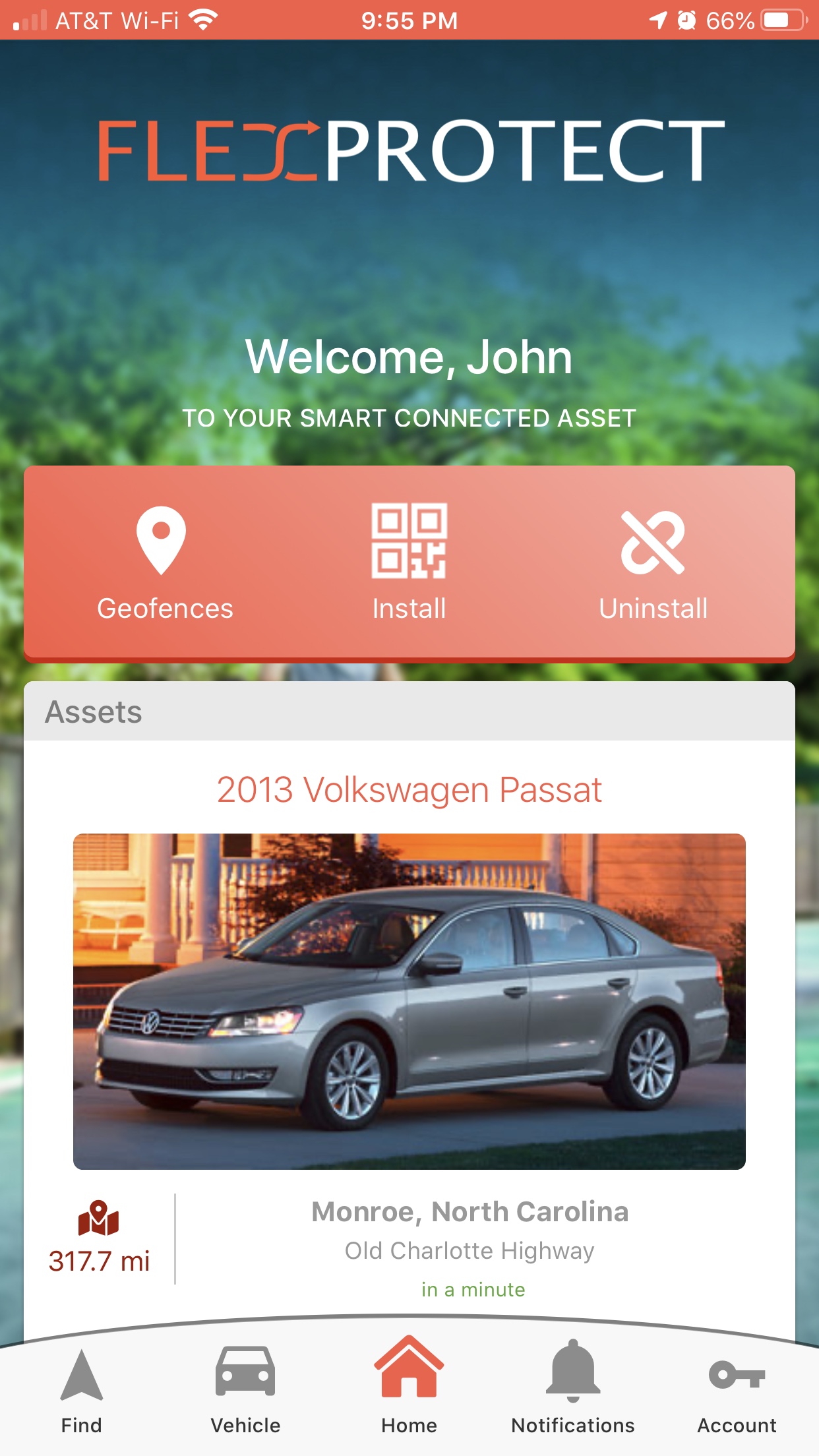

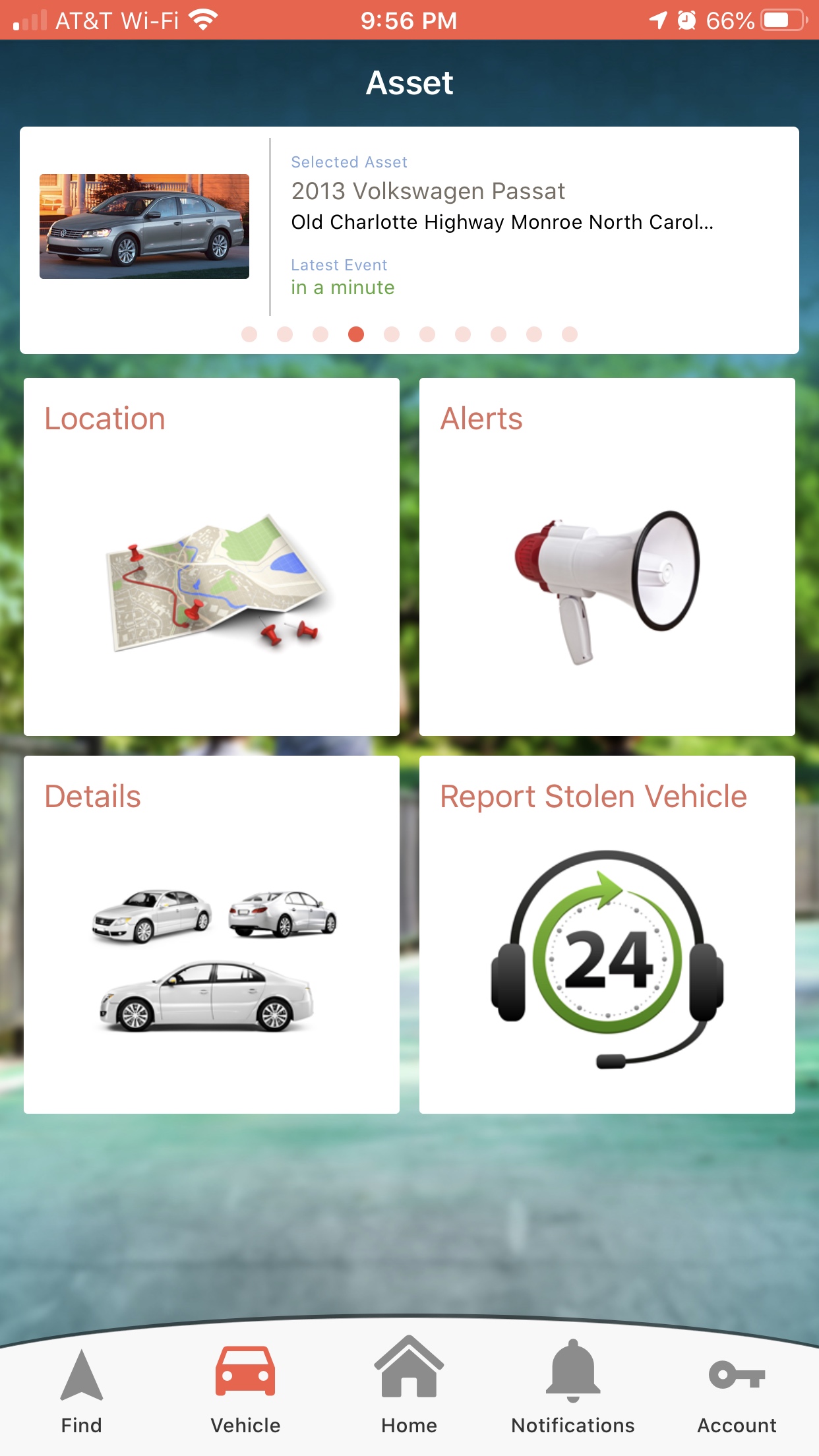

CONNECTED DRIVER APP

FlexProtect™ Connected Car app puts high-value vehicle information right on consumer’s phones and can create a substantial new profit center for lenders and dealers. With easy to use features for reporting stolen vehicles, monitoring vehicle location and driver behavior, plus an integrated dealer messaging service, theFlexProtect™ Connected Car App is a powerful new loan management and revenue tool.

-

Payment Reminder

-

In-App Payments

-

Family Geofences

-

Trip Reports

-

Teen/Parent Monitoring

-

Speed Alerts

-

Roadside Assistance

FLEXIBLE REPORTS

Seeing the message behind the data is critical to effective loan and dealership management. Given the volume of vehicle data captured by the FlexProtect Vehicle Finance Solution, easy to configure and schedule reporting is a must-have to help lenders and dealers maximize results.

-

Custom Reports

-

Scheduled Reports

-

Favorite Reports

-

Distribution Lists

-

Export Reports